Summary

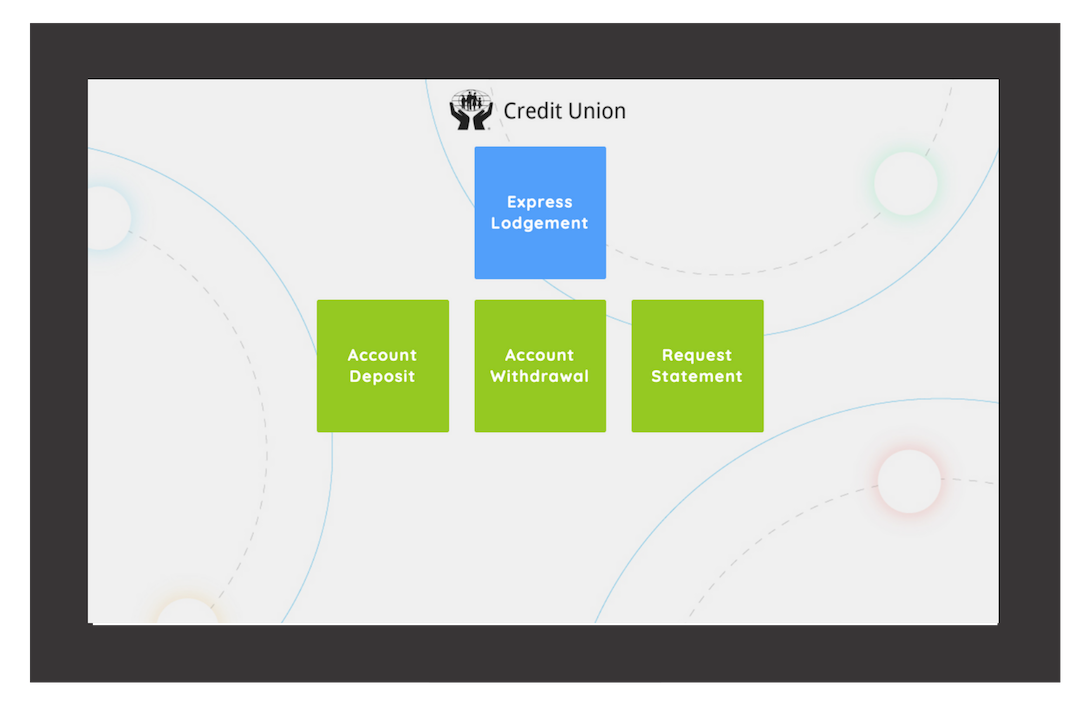

When Letterkenny Credit Union introduced their kiosk in-branch in 2016, their main objective was to reduce footfall at the counter for standard transactions. The strategy behind this was to give their staff more time for processing loan applications and marketing new services to their members.

Little did they know, just 4 years later, the kiosk would also become an essential tool for social distancing in-branch.

Since the outbreak of Covid-19 in March 2020, staff at Letterkenny Credit Union have increased their kiosk transactions by 170%. This not only allows them to maintain their vital services, it also helps to keep their members and staff safe during this pandemic.